Your Tax-Free Savings Account (TFSA) is the perfect spot for Canadian exchange-traded funds (ETFs)—and here’s why.

Unlike American ETFs, where dividends can be hit with a 15% foreign withholding tax, Canadian ETFs retain their full dividend value in a TFSA.

Personally, I always lean towards ETFs that offer broad diversification and low fees, as they tend to be the most accessible and advantageous for beginners and long-term investors alike.

Here are my top two ETF picks for maximizing the benefits of your TFSA today.

BMO S&P/TSX 60 Index ETF

If you’re looking for straightforward, inexpensive exposure to Canada’s largest blue-chip stocks, the BMO S&P/TSX 60 Index ETF (TSX:ZIU) is the perfect choice.

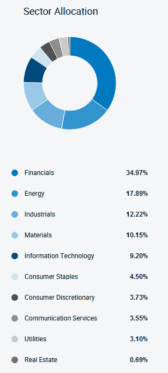

This ETF offers a no-frills way to access a broad and diversified slice of the Canadian stock market. Its top holdings include many household names, and while it’s heavily tilted towards financials and energy sectors, it represents a well-rounded portfolio.

With a decent 2.74% dividend yield and quarterly payouts, it’s attractive if you like getting tax-free passive income in a TFSA.

Most importantly, it has a low management expense ratio (MER) of 0.15%, which means you’re only paying about $15 in fees per $10,000 invested.

BMO Canadian Dividend ETF (ZDV)

If you’re aiming for a higher yield than the 2.74% offered by ZIU, the BMO Canadian Dividend ETF (TSX:ZDV) might be a better fit.

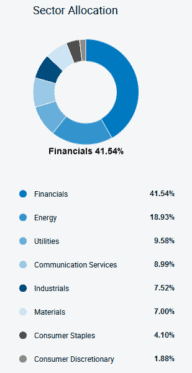

Unlike ZIU, ZDV doesn’t track a specific index. Instead, it employs a rules-based strategy to select stocks based on their three-year dividend growth rate, yield, and payout ratio.

This method results in a higher management expense ratio (MER) of 0.39%, but it also delivers a more attractive yield of 3.83%. Plus, ZDV offers the convenience of monthly payouts.

I appreciate ZDV for its balanced portfolio; while it still includes many of the same top companies as ZIU, it features broader sector representation, though it remains heavily weighted towards financials.

The Foolish takeaway

Either ZIU or ZDV could serve as excellent choices for Canadian stock exposure within your TFSA.

ZIU is an ideal one-stop shop for those looking to broadly mirror the performance of Canada’s top 60 blue-chip stocks, making it a straightforward choice for hassle-free diversification.

On the other hand, ZDV could be the better pick if you’re focused on generating income; its higher dividend yield and monthly payout structure make it a strong core holding.

You could also complement ZDV with some selected Canadian growth stocks to enhance potential returns and portfolio balance.